Would you like to start paying off debt and escaping the trap of high-interest loans? A personal budget will provide a roadmap of what you’re permitted to spend so that you’ll meet your financial goals. It doesn’t make any difference whether you’re looking to set a family budget or are a college student worried about how to pay your loans — budgeting can help you meet your personal financial goals. Budgeting allows you to analyze your cash flow and expenses, holding you accountable each week and month.

Inputting and Categorizing Transactions

But if you want to make the most of Excel, using a purpose-built accounting template for your bookkeeping can help keep everything on track and professional. While these spreadsheets may be more on the specialised side, there is the option to customise them to suit the needs of your business – especially if you happen to be customer-facing or retail-based. Then TouchBistro has you covered with a quartet of innovative, free spreadsheets to aid in your bookkeeping and keep everything on track. With options for GST and non-GST, there’s enough here to ensure your business covers all the necessary avenues without investing in costly software. Ideal for those starting out or looking to learn the ropes of bookkeeping before they commit to anything.

Compare Small Business Loans

Since this file contains valuable information regarding your company’s bank accounts and accounting records, it’s vital to ensure its security. If you want to generate monthly income statements, you’ll need to create 12 sheets, 1 for each month. Ensure to label each one and enter the proper date range to avoid confusion. Bookkeeping in Excel involves using Microsoft Excel to record transactions and financial data for your small business.

- If your business buys or sells products or services on credit, then the Accounting Template by ClickUp is for you.

- If you want a more detailed breakdown, you can either switch to the Income List or Expense List view to visualize your income and expenses grouped by their respective sources and sinks.

- Otherwise, you’ll lose them and might not be able to prove certain expense deductions if you get audited.

- The more you can understand and define these needs, the better you will do in attracting and retaining your business clients.

- If you haven’t landed on an entity type yet, you can read more about choosing the right business entity for your startup here.

- Those who haven’t used Excel before or aren’t familiar with its features can download Excel bookkeeping templates online.

- I have used the Excel bookkeeping template for a few weeks now and I am amazed at its simplicity.

Price your services

If you’re brand new to Excel and entirely new to the world of digital accounting, Beginner Bookkeeping might be the best choice for you. If you’re looking for something that’s super customisable to the needs and goals of your startup bookkeeping business, Smartsheet delivers. Getting started with bookkeeping doesn’t have to mean high-tech software and expensive training. Use that data to negotiate volume discounts or to shop around for a better price on that service.

It could also be when you expect to hire your Xth employee or launch a new location. Think about ways you will outperform your competition and document them in this section of your plan. With regards to the last two questions, think about your answers from the customers’ perspective.

- You can also use a free version of Excel by opening a Microsoft account.

- Figuring out what to charge is any small-business owner’s greatest challenge.

- A business plan will help you raise funding, if needed, and plan out the growth of your bookkeeping business in order to improve your chances of success.

- What happens when you need to find something quickly, but it’s missing?

- Get a snapshot of your monthly profit and loss report by entering your financial data and selecting the month that you want to view in the dashboard.

- So, for example, if your customer signs a big contract, you’d consider the money earned, even if they haven’t paid you yet.

- The template automatically populates the accounts receivable aging sheet after you fill in the payment ledger.

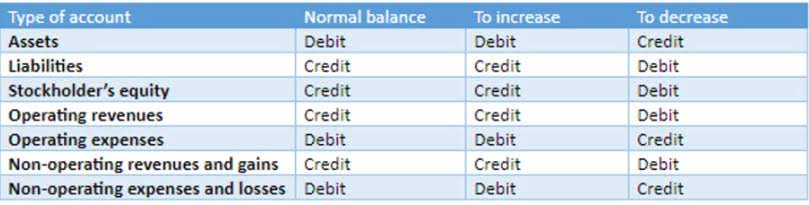

- Many of the operations are automated in the software, making it easy to get accurate debits and credits entered.

- This template lets you identify your top clients (aka ”large accounts”), so you can create tailored strategies to nurture these relationships for long-term success.

- Luckily, Microsoft Excel is very accessible and there are a variety of templates available to guide you if you do decide to perform your basic bookkeeping using Excel (or even using Google Sheets).

- Excel already has a great variety of Invoice templates included in their system.

- To do this, you’d review your transactions for the time period and then add totals for each account.

- Start by turning your initial concept or idea into a written plan of action called a business plan.

This is a very simple Excel workbook for helping self-employed people record income and expense transactions from all sources (bank accounts, credit cards and cash) for any date. See the big picture of your budget with this first-year-specific startup budget calculator. You can save this first-year startup budget calculator template as a unique file with customized entries, or share it with other team members who need details of your startup’s financial viability.

Transactions include sales, payroll, bills, debt, interest earned, tax payments and more. With accrual accounting, revenue and expenses are recorded when transactions occur, regardless of when money exchanges hands. Sales get booked at the time of invoicing rather than when you collect payment.

Cash Flow Statement

A well-crafted business plan not only outlines the vision for your company, but also documents a step-by-step roadmap of how you are going to accomplish it. In order to create an effective business plan, you must first understand the components that are essential to its success. We have a detailed guide on how to make an expense spreadsheet that simplifies the process of business expense management. What’s more, Excel isn’t the best program for creating cash flow statements and sharing them with investors or other parties. That way, you’ll be able to cross-reference the data, check for errors, and ensure you don’t enter an invoice payment twice or forget to enter it. The chart of accounts is a sheet that contains a list of accounts that make up your books.

Then we included a few budget planner tips to help you start planning. Whether you need a budget tracker for your small business or to use as a personal money manager tool, you’ll likely find our free budget template worthwhile. Hiring an employee to provide bookkeeping services can be helpful to some startups, especially when business growth leads to a large increase in transaction volume. Bookkeepers are helpful because they can focus solely on maintaining accurate and timely records, whereas startup founders often have to juggle bookkeeping with running a business.